Introduction

In the evolving landscape of mergers and acquisitions (M&A), the strategic capabilities and vision of the acquiring company profoundly influence the trajectory and ultimate success of the acquired assets. This principle holds true across various sectors, illustrating how adept leadership and strategic foresight can unlock significant growth and transformative potential. Deloitte’s 2024 M&A Trends Survey highlights a rebound in M&A activity with an increase in both deal volume and value, driven by strategic alignment and the use of advanced technologies. Here, we explore five critical transformative powers of strategic ownership that can redefine an asset’s trajectory and maximize its value, ensuring that acquisitions serve as pivotal growth vectors rather than mere expansions of footprint.

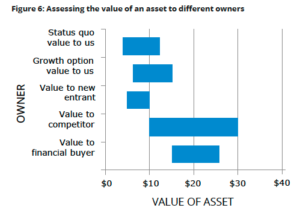

According to Deloitte’s “M&A Making the deal work” report, in the dynamic M&A landscape, identifying the most suitable owner for a business unit can significantly enhance its intrinsic value, addressing both operational efficiencies and capital market pressures. This optimal owner, often termed the “natural owner,” is not necessarily the current holder but the one who can generate the most value from the assets through various strategies like leverage, financial engineering, or by creating synergies that the current owner cannot.

Source: Deloitte.

One – Strategic Fit: Aligning Visions for Accelerated Growth

Strategic fit is the bedrock of any successful acquisition, crucial for ensuring that the acquired asset complements and enhances the acquiring entity’s overarching goals and strategies. It involves a deep integration that goes beyond surface-level alignment, embedding the acquired company’s strengths into the acquiring company’s fabric to drive combined forward momentum.

- Essence of Strategic Fit: This involves not just merging two businesses but aligning them in such a way that their combined strength is greater than the sum of their parts.

- Illustrative Example: Google’s acquisition of YouTube for $1.65 billion in 2006 is a textbook case of strategic fit. Initially, YouTube struggled with profitability; however, under Google’s stewardship, it leveraged Google’s robust advertising network and advanced technological infrastructure to become a global video-sharing powerhouse. By 2020, YouTube generated an impressive $19.77 billion in advertising revenue, showcasing the dramatic increase in asset value under strategic ownership.*

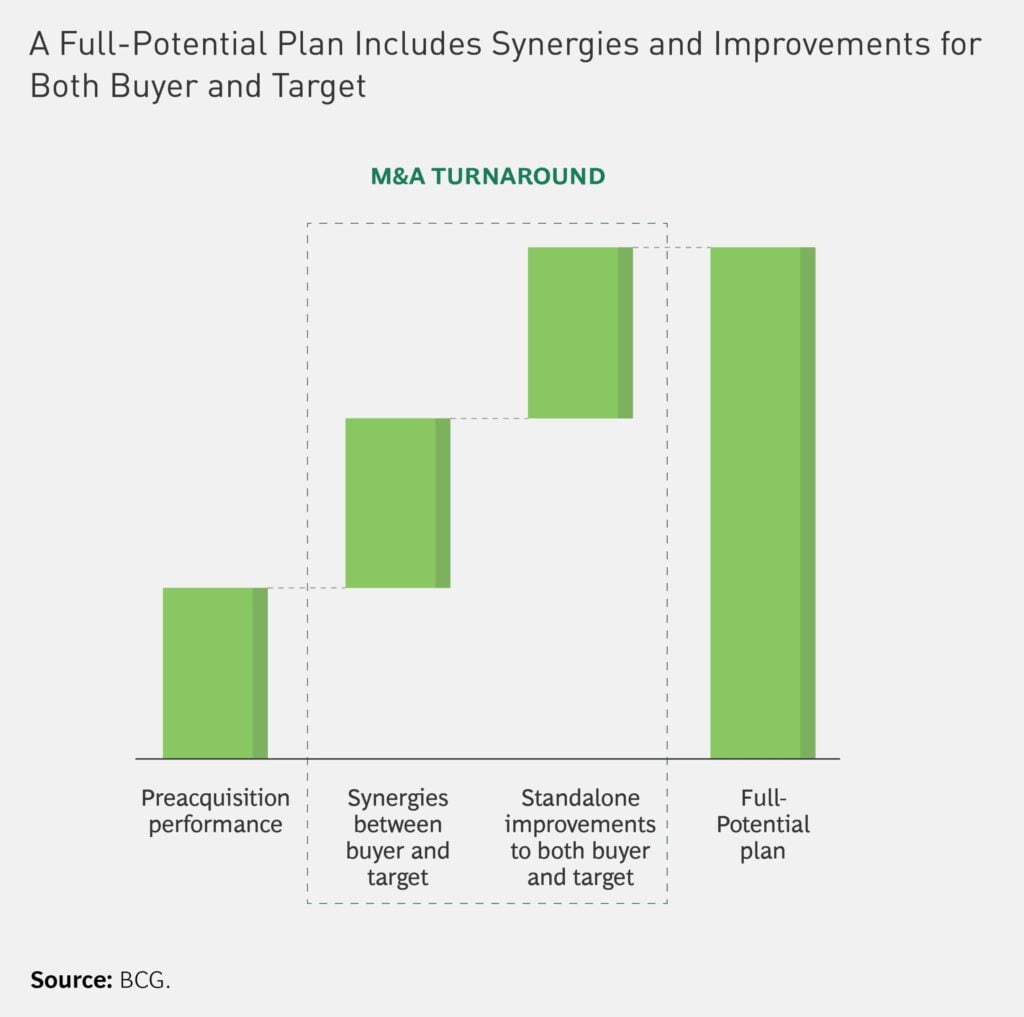

Two – Leveraging Synergies: Enhancing Value Through Integration

Synergies are integral to M&A success, arising from the integration of technologies, cultures, and operations. They enhance overall business efficiency and strategically position the company in the marketplace. Deloitte’s survey underscores the importance of these synergies, with a focus on strategic alignment enhancing deal value.

- Key Areas of Synergy:

- Operational Efficiencies: Streamlining processes to reduce costs and improve productivity.

- Technology Integration: Merging technology platforms to enhance product offerings and customer experiences.

- Market Expansion: Combining strengths to access new markets and customer segments.

- Case Study: When Microsoft acquired LinkedIn for $26.2 billion in 2016, it wasn’t just purchasing a professional network; it was acquiring a synergistic platform that could enhance its entire suite of enterprise solutions. This strategic integration has been crucial, with LinkedIn’s revenue growing to approximately $10 billion in the fiscal year 2021—a testament to the power of leveraging synergies.*

Three – Visionary Leadership: Directing Post-Acquisition Success

The success of an acquisition significantly depends on the vision and direction provided by leadership. Visionary leaders can foresee potential that others overlook and steer the acquisition towards achieving unprecedented success.

- Traits of Visionary Leadership:

- Ability to envision future market trends and position the company accordingly.

- Courage to make bold decisions that may not align with conventional wisdom.

- Capability to inspire and motivate a diverse group of stakeholders towards common goals.

- Success Story: Disney’s acquisition of Pixar for $7.4 billion not only expanded Disney’s portfolio but revitalized its entire animation division. Leadership foresight was critical in preserving Pixar’s innovative culture, which significantly enhanced Disney’s offerings, leading to a substantial increase in studio entertainment revenues to $11.13 billion by 2019.*

Four – Cultural Integration: Facilitating Smooth Transitions

Effective cultural integration is essential for retaining key talent and maintaining operational stability. It involves merging different corporate cultures in a way that respects both entities’ values and traditions, fostering a new unified culture that supports strategic objectives.

- Strategies for Successful Cultural Integration:

- Conduct detailed cultural assessments before the merger to identify potential friction points.

- Develop a comprehensive integration plan that includes structured communication strategies.

- Foster an inclusive environment that values the input and engagement of employees from both companies.

- Real-World Example: Amazon’s $13.7 billion acquisition of Whole Foods in 2017 successfully merged Amazon’s cutting-edge technology and operational efficiencies with Whole Foods’ commitment to quality and natural products. This strategic cultural alignment allowed Whole Foods to stabilize its brand and expand its market reach while addressing challenges like high price perception and digital commerce adaptation.

Five – Continuous Innovation: Fueling Long-Term Growth

Continuous innovation post-acquisition is crucial for keeping the merged entity competitive and relevant. It involves ongoing investments in research and development, enhancing products and services, and adopting cutting-edge technologies.

- Innovation Focus Areas:

- Product Development: Continuously improving and expanding product lines to meet evolving customer needs.

- Technology Upgrades: Adopting the latest technologies to improve efficiency and customer engagement.

- Market Expansion: Entering new geographical and demographic markets to expand the company’s footprint.

- Example Highlight: Adobe’s acquisition of Marketo and Magento in 2018 significantly enhanced its Digital Experience platform. In fiscal year 2019, the Digital Experience segment’s revenue reached $3.21 billion, marking a substantial 31% increase from $2.44 billion in fiscal 2018. This impressive growth was primarily driven by the increase in subscription revenue following the strategic integrations of Marketo and Magento. The addition of these acquisitions has not only expanded Adobe’s product suite but also significantly boosted its revenue, underscoring the transformative power of effective M&A activity in the tech sector.*

Conclusion

The transformative power of strategic ownership in mergers and acquisitions cannot be overstated. By effectively harnessing strategic fit, synergies, visionary leadership, cultural integration, and continuous innovation, companies can not only maximize the intrinsic value of their acquisitions but also set a robust foundation for long-term success and market leadership. Each element plays a critical role in transforming a routine acquisition into a strategic powerhouse, essential in today’s competitive business environment.

*Source: Company’s annual reports