Quality of Earnings (QoE) Analysis in Financial Due Diligence

When preparing a business for sale, the Quality of Earnings (QoE) report often becomes a centerpiece of the process. But what exactly is it, and why does it matter so much?

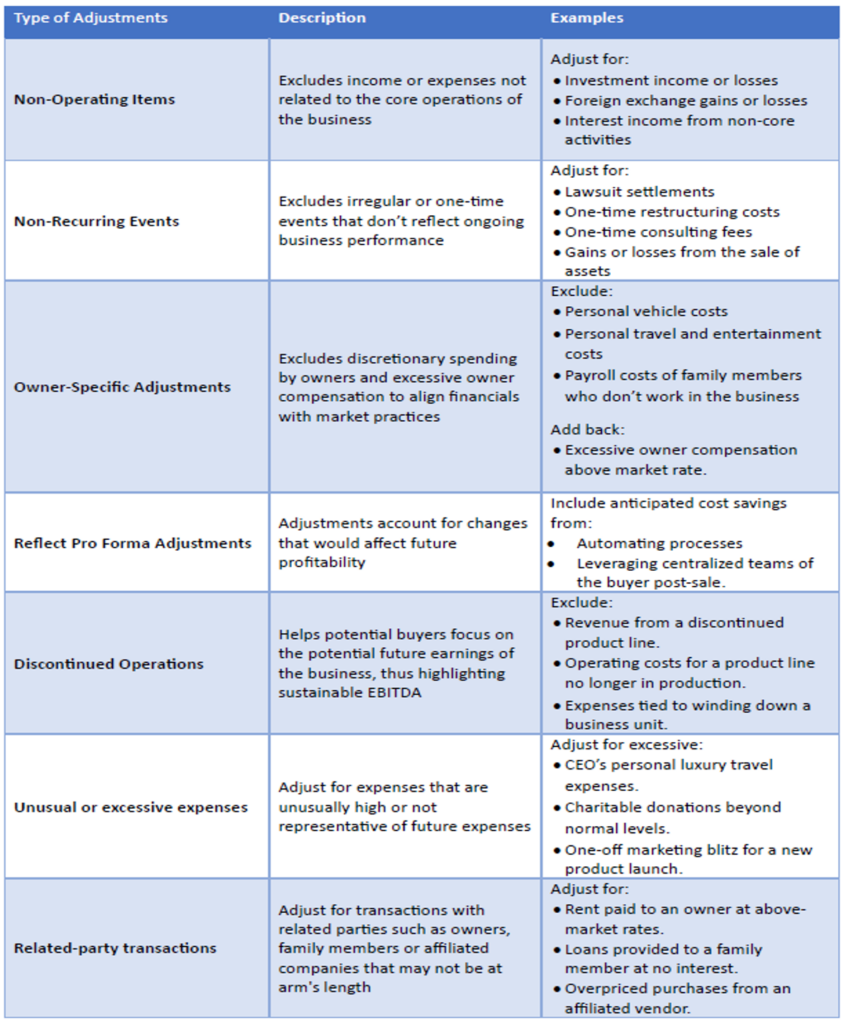

A QoE report dives deep into a company’s earnings, separating recurring revenues from one-time windfalls and identifying trends, risks, and irregularities. It answers a key question for potential buyers: “Is this business’s financial performance sustainable in the future?”

Unraveling Business Combinations: Navigating Accounting Challenges

In the dynamic world of business, expansion and diversification are often crucial strategies for long-term success. However, these strategic moves can open new doors while also unveiling intricate challenges

Harnessing Tax Savings with IRC Section 1202: Qualified Small Business Stock (QSBS)

Taxes are an inevitable part of our financial lives, but savvy investors and entrepreneurs are always on the lookout for legal ways to reduce their tax liabilities.

Expanding Your Startup into the US Market: Key Considerations

Expanding a business into new markets is a thrilling venture, but it’s also a complex undertaking that requires careful planning and execution.

Investment in the USA: Choosing the Right Business Structure for Foreign Investors

Imagine a global entrepreneur with big dreams setting their sights on the United States, a land of endless possibilities.

Crafting a Compelling Investor Deck: The Key to Successful Capital Raising

In the competitive landscape of fundraising, securing additional capital is a crucial milestone for businesses of all sizes and industries.

Navigating Changes to Internal Revenue Code (IRC) Sec 174

Change is the only constant in the world of taxation, and businesses must continually adapt to evolving regulations. One such change that demands our attention is the transformation of Internal Revenue Code (IRC)

Demystifying Debt-to-Equity Conversions for Startups: Navigating IRS Section 163(I) with Success

Introduction: Greetings to all startup enthusiasts and entrepreneurs! At our accounting firm, we are dedicated to providing valuable insights and guidance to businesses aiming for financial prosperity.

ESG in Investing

In recent years, interest in environmental, social, and governance (ESG) investing has exploded. This increased interest is a result of a growth in global business risk