Foundational Principles of Business Valuation

Valuing a business with precision is critical for a range of strategic decisions, from securing investor funding to executing a successful exit strategy. The three primary valuation approaches widely recognized in the field are the Income Approach, the Market Approach, and the Cost Approach. Each of these methodologies provides distinct perspectives and is applicable to various types of businesses and scenarios. Within these broad approaches, several specific methods can be employed, each chosen based on a set of unique factors and circumstances pertinent to the business in question. The methods discussed herein represent just a few of the available techniques.

Additionally, it is imperative to consider qualitative factors during the valuation process. Elements such as the strength and expertise of the management team, the strategic vision, market positioning, and the level of innovation and proprietary technology can significantly influence the perceived value of a business. These qualitative aspects often provide a more comprehensive understanding of the business’s potential for long-term success and sustainability, which can be pivotal in making informed valuation decisions.

One: Income Approach

The Income Approach is based on the principle that a business’s value is the present value of its future earnings. This approach involves several key steps and considerations:

- Discounted Cash Flow (DCF) Method:

- Estimating Future Cash Flows:

- Forecasting Cash Flows: This involves projecting the business’s revenue, expenses, and net cash flows over a discrete period, typically three to ten years. Projections should ideally be based on management’s estimates, historical performance, industry trends, and market conditions.

- Discrete Projection Period: The length of this period depends on how long it is expected for the business to achieve a stabilized level of earnings.

- Discount Rate:

- Determination of Discount Rate: The discount rate reflects the risk associated with the future cash flows and is often calculated using the Weighted Average Cost of Capital (WACC). This rate considers factors such as business risk, market risk, financial leverage, and company size.

- Capital Asset Pricing Model (CAPM): Often used to derive the discount rate, CAPM considers the risk-free rate, beta (a measure of market risk), and the equity market premium.

- Terminal Value Calculation:

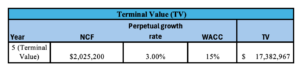

- Terminal Value: At the end of the discrete projection period, a terminal value is calculated to capture the value of all subsequent cash flows into perpetuity. This can be done using the Gordon Growth Model, which assumes a perpetual growth rate.

- Single Period Capitalization Method:

- Simplification of DCF: The single period capitalization method is a simpler version of the DCF, used when future cash flows are expected to grow at a constant rate indefinitely.

- Capitalization Rate: This rate, calculated as the discount rate minus the perpetual growth rate, is applied to the next year’s cash flow to determine the business’s value.

When to Use:

- Ideal for businesses with stable and predictable cash flows.

- Suitable for detailed financial modeling and long-term investment analyses.

Normalizing Adjustments:

- Adjustments to Financial Statements: These adjustments ensure that the income statement reflects the normal operations of the business. Non-recurring, unusual items and discretionary expenses are adjusted to provide a more accurate picture of the business’s ongoing profitability.

Two: Market Approach

The Market Approach determines a business’s value based on the prices of similar companies or transactions. This approach relies on comparative analysis to establish the value of a business by examining the financial and operational metrics of similar companies in the same industry. The key methodologies within the Market Approach include:

- Guideline Public Company Method:

- Identification of Comparable Companies: Valuation professionals identify publicly traded companies that are similar to the subject company in terms of industry, size, growth prospects, and other relevant factors.

- Valuation Multiples: Commonly used multiples include EV/EBITDA (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization), P/E (Price to Earnings), and EV/Sales. These multiples are applied to the subject company’s corresponding metrics to estimate its value.

- Guideline Transactions Method:

- Comparable Transactions: This method involves analyzing recent merger and acquisition transactions of companies similar to the subject company. The transaction multiples derived from these deals are used to value the subject company.

- Data Sources: Data for comparable transactions is often sourced from databases that provide details on transaction prices, financial metrics, and deal structures.

- Considerations: This method considers the timing of the transactions, the economic environment at the time, and any deal-specific factors such as earnouts or strategic buyer motivations.

- Transactions in the Stock of the Subject Company:

- Recent Transactions: Analyzing recent transactions involving the subject company’s own stock can provide valuable insights, especially if these transactions were conducted at arm’s length.

- Venture Capital Investments: In the case of startups, recent venture capital investments can be used to infer the company’s value, but adjustments must be made for any preferences or special rights associated with the investment.

When to Use:

- Best for industries with active markets and numerous comparable transactions.

- Useful for companies with peers that are publicly traded or have been recently acquired.

Three: Cost Approach

The Cost Approach values a business based on the sum of its assets minus its liabilities. This method assumes that the value of a business is equivalent to the cost of replacing its assets. The approach typically involves:

- Asset Valuation: Determining the current replacement cost of the company’s tangible and intangible assets.

- Deducting Liabilities: Subtracting the total liabilities from the asset value to arrive at the business’s net value.

Key Methodologies:

- Replacement Cost Method: Values the business based on the cost to replace its assets with similar ones at current prices, adjusted for obsolescence.

- Reproduction Cost Method: Estimates the cost to reproduce the exact replica of the existing asset.

When to Use:

- Suitable for capital-intensive businesses or holding companies with substantial physical assets.

- Useful when income and market approaches are not feasible or when valuing unique or specialized assets.

Enhancing Startup Valuation Through Qualitative Factors

The value of a startup is not solely dependent on a robust customer base. Even in the absence of extensive traction, a startup can hold significant value if it has developed a Minimum Viable Product (MVP) that effectively addresses a real problem. Don’t discount the importance of vision, strategy, and intellectual property (IP) while considering the valuation of your startup. Qualitative aspects such as a strong management team, a compelling vision, strategic market positioning, and proprietary technology can significantly enhance the perceived value of your business.

Case Study: Valuing a SaaS Startup

Background:

SampleTechNova, a SaaS startup, has developed a cloud-based project management tool tailored for small to medium-sized businesses. After 18 months in the market, SampleTechNova has gained traction with a growing customer base and increasing monthly recurring revenue (MRR). The company has a strong product-market fit, evidenced by low churn rates and high customer satisfaction scores.

Approach and Methodology:

For SampleTechNova, the Income Approach with a focus on the Discounted Cash Flow (DCF) Method was used. This approach was selected due to the company’s consistent revenue streams and the ability to forecast future cash flows reliably.

Discounted Cash Flow (DCF) Method:

1.Estimating Future Cash Flows:

- Projection Period: Future cash flows are projected for a five-year period. This projection is based on SampleTechNova’s historical financial data, current market trends, and growth assumptions.

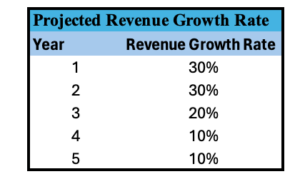

- Revenue Growth: A high initial growth rate is assumed due to the increasing adoption of the platform. This growth rate gradually tapers off as the market matures.

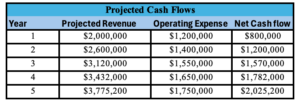

- Cash Flow Calculation:

- Revenue: Forecasted based on current MRR, growth rates, and expected customer acquisition.

- Operating Expenses: Estimated by analyzing historical data and projecting future trends, including marketing, administrative, customer support, and technology infrastructure expenses.

- Discount Rate:

- WACC Calculation: The Weighted Average Cost of Capital is calculated to reflect the company’s cost of equity and debt. Given SampleTechNova’s early stage, a higher cost of equity was assumed to account for the increased risk.

- Terminal Value Calculation:

- Used to estimate the terminal value at the end of the projection period, assuming a perpetual growth rate.

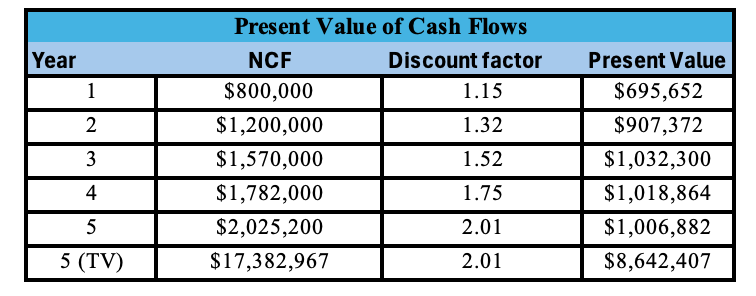

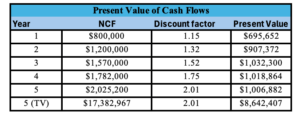

- DCF Valuation:

- Present Value of Cash Flows: The forecasted cash flows and terminal value were discounted back to their present value using the WACC.

Total Present Value (PV) = $13,303,478

Key Assumptions:

In the valuation of SampleTechNova, the following key assumptions were made:

- Revenue Growth Rate: 30% in the first two years, tapering to 10% by year five.

- Discount Rate (WACC): 15% reflecting the higher risk associated with an early-stage startup.

- Perpetual Growth Rate: 3% beyond the projection period.

These assumptions were based on a thorough analysis of SampleTechNova’s historical performance, market conditions, and strategic plans. By ensuring that assumptions are well-founded and carefully considered, the valuation process can provide a more accurate and insightful estimate of the company’s worth.

Outcome: The DCF method resulted in a valuation of $13.3 million for SampleTechNova. This valuation reflects the company’s strong growth potential, reliable cash flow generation, and the effective execution of its business model. The Income Approach, particularly the DCF method, was ideal for valuing SampleTechNova due to its predictable revenue streams and growth trajectory. This method provided a comprehensive valuation by considering future cash flows and the risk associated with the business, offering a clear picture of its potential worth to investors.

Final Thoughts: When valuing a SaaS startup, it is crucial to consider not only the quantitative aspects such as revenue and cash flow but also the qualitative factors like market position, customer satisfaction, and growth potential. A robust valuation approach combining both these elements can provide a realistic and reliable estimate of the company’s worth.

Disclaimer and Important Information

This content supports our marketing efforts for professional services and is not personalized accounting or tax advice. If you’re interested in these topics, we encourage you to reach out to us or a qualified professional for advice tailored to your specific situation. Nothing in this content restricts anyone from disclosing tax treatment or structure. If you need personalized tax or accounting advice, consult us or another qualified professional. This information is general and subject to change; it’s not accounting, legal, or tax advice. It may not apply to your unique circumstances and requires considering additional factors. Tax and accounting laws and other factors may change, and we are not obligated to update you on these changes.