Understanding the Three Key Approaches to Valuing a Business

Valuing a business with precision is critical for a range of strategic decisions, from securing investor funding to executing a successful exit strategy. The three primary valuation approaches widely recognized in the field are the Income Approach, the Market Approach, and the Cost Approach. Each of these methodologies provides distinct perspectives and is applicable to various types of businesses and scenarios. Within these broad approaches, several specific methods can be employed, each chosen based on a set of unique factors and circumstances pertinent to the business in question. The methods discussed herein represent just a few of the available techniques.

Additionally, it is imperative to consider qualitative factors during the valuation process. Elements such as the strength and expertise of the management team, the strategic vision, market positioning, and the level of innovation and proprietary technology can significantly influence the perceived value of a business. These qualitative aspects often provide a more comprehensive understanding of the business’s potential for long-term success and sustainability, which can be pivotal in making informed valuation decisions.

5 Transformative Powers of Strategic Ownership in Mergers and Acquisitions

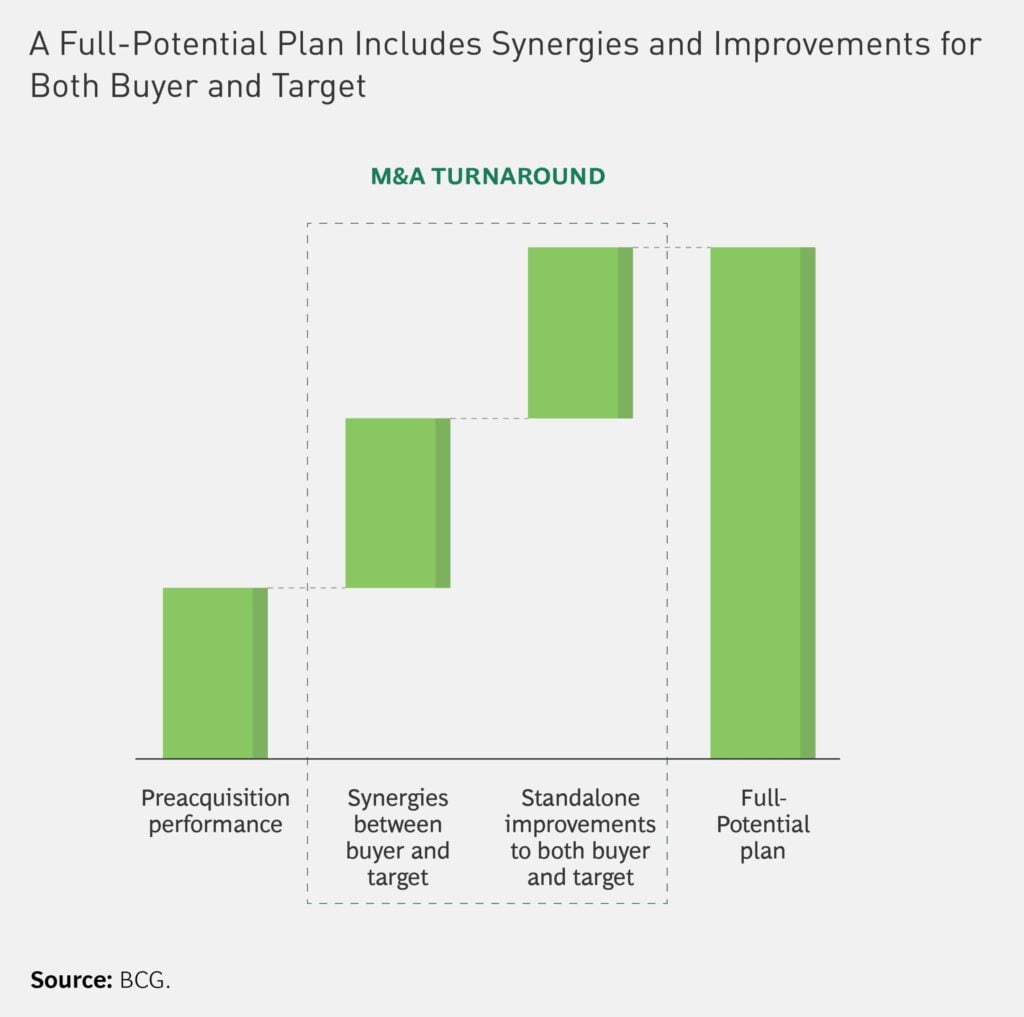

In the evolving landscape of mergers and acquisitions (M&A), the strategic capabilities and vision of the acquiring company profoundly influence the trajectory and ultimate success of the acquired assets.

Unraveling Business Combinations: Navigating Accounting Challenges

In the dynamic world of business, expansion and diversification are often crucial strategies for long-term success. However, these strategic moves can open new doors while also unveiling intricate challenges